Leading Accounting Services in Singapore

Transform your finances with Grof’s accounting services in Singapore.

Professional accounting services from bookkeeping to tax compliance, we provide a comprehensive solution that helps you stay on top of your finances and reach your goals. Trusted by 2,000+ businesses, we offer transparent pricing with no hidden charges.

How Can We Help?

Eliminate Paperwork Hassles With Grof's Outsourced Accounting and Bookkeeping Services In Singapore

Our expert team is here to support your business with outsourced accounting in Singapore—covering bookkeeping, payroll, tax compliance, and GST registration. We also provide corporate solutions like company secretary and incorporation services.

Annual Tax

Return Filing ensure compliance and peace of mind with our expert tax filing services in Singapore.

Bookkeeping

Efficiently manage your finances with our detailed monthly or annual bookkeeping services.

Financial Reports

Receive concise financial reports monthly or annually to enhance your business decision-making.

Payroll

Streamline your payroll management to save time and minimise errors.

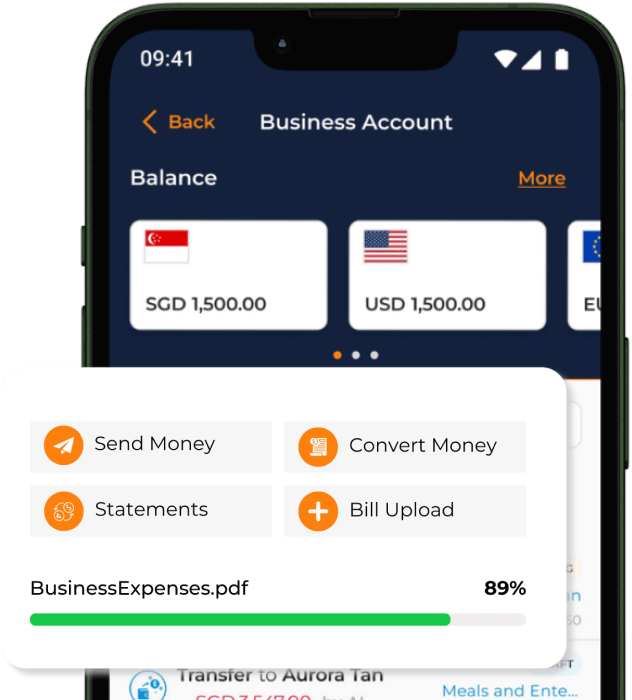

Free Financial Tools

Streamline your finances with our free app featuring a business account, expense management, and a corporate card.

XBRL Report Preparation

Enhance your financial reporting with our precise and efficient XBRL services.

Say Goodbye to Paperwork and Excel Woes. Let's Grof!

-

Time Saver

Give yourself a break from balancing your books and managing tax claims. Reclaim your time and energy to focus on your business operations.

-

Experts Support

Our team of seasoned accountants, backed by decades of experience, will ensure your books are in good hands and well managed.

-

Scaling Your Business Easily

Outsource your accounting and bookkeeping gives you the flexibility to adjust your workload as your company's activities change.

Get the Right Package

Choose an accounting package that aligns with your budget and business needs.

-

-

Dedicated Accountant

- Annual Bookkeeping

- Support SLA within 3 working days

-

Compliance & Tax Filing

- Unaudited financial statements

- Annual tax return filing

-

Financial Management Solutions

- Annual financial reports

-

Free Financial Tools

- Save up to 70% on FX transfer charges for local and overseas transfers.

- Digitalise bills and receipts for expense tracking and integrated bill payments.

- Issue unlimited corporate cards with adjustable spending limits to simplify your budgeting.

-

Add-ons

- + S$ 500 /year - XBRL report preparation

-

-

-

Dedicated Accountant

- Monthly Bookkeeping

- Support SLA within 2 working days

- Basic tax planning & advice

- Quarterly review meetings with accountant

-

Compliance & Tax Filing

- Unaudited financial statements

- Annual tax return filing

-

Financial Management Solutions

- Monthly financial reports

-

Payroll

- Preparing monthly payroll report, Central Provident Fund (CPF) report and payslip accessible from payroll software.

- Issuance of monthly payslip and payroll report.

- Ensure Central Provident Fund (CPF) registration, Skills Development Levy (SDL) payment assistance and Self-Help Group (SHG) payment submissions via GIRO.

- Expense claims reimbursement.

- Annual Return of Employees Remuneration (Form IR8A) via Auto-Inclusion Scheme (AIS)

- Employee leave management

-

Free Financial Tools

- Save up to 70% on FX transfer charges for local and overseas transfers.

- Digitalise bills and receipts for expense tracking and integrated bill payments.

- Issue unlimited corporate cards with adjustable spending limits to simplify your budgeting.

-

Add-ons

- + S$ 500 /year - XBRL report preparation

- + S$ 250 /quarter - quarterly GST filing

-

-

-

Dedicated Accountant

- Annual Bookkeeping

- Support SLA within 3 working days

-

Compliance & Tax Filing

- Unaudited financial statements

- Annual tax return filing

-

Financial Management Solutions

- Annual financial reports

-

Free Financial Tools

- Save up to 70% on FX transfer charges for local and overseas transfers.

- Digitalise bills and receipts for expense tracking and integrated bill payments.

- Issue unlimited corporate cards with adjustable spending limits to simplify your budgeting.

-

Add-ons

- + S$ 500 /year - XBRL report preparation

-

-

-

Dedicated Accountant

- Monthly Bookkeeping

- Support SLA within 2 working days

- Basic tax planning & advice

- Quarterly review meetings with accountant

-

Compliance & Tax Filing

- Unaudited financial statements

- Annual tax return filing

-

Financial Management Solutions

- Monthly financial reports

-

Payroll

- Preparing monthly payroll report, Central Provident Fund (CPF) report and payslip accessible from payroll software.

- Issuance of monthly payslip and payroll report.

- Ensure Central Provident Fund (CPF) registration, Skills Development Levy (SDL) payment assistance and Self-Help Group (SHG) payment submissions via GIRO.

- Expense claims reimbursement.

- Annual Return of Employees Remuneration (Form IR8A) via Auto-Inclusion Scheme (AIS)

- Employee leave management

-

Free Financial Tools

- Save up to 70% on FX transfer charges for local and overseas transfers.

- Digitalise bills and receipts for expense tracking and integrated bill payments.

- Issue unlimited corporate cards with adjustable spending limits to simplify your budgeting.

-

Add-ons

- + S$ 500 /year - XBRL report preparation

- + S$ 250 /quarter - quarterly GST filing

-

-

Expenses more than S$ 150k annually?

We have the perfect offer for your business, and we are ready to discuss it with you!

Why Choose Grof?

How we can help you to grow your ideas into the real deal.

-

100% Online Processes

Ready to bring your business idea to life? Send us your details right away, all from the comfort of your home.

-

Reliable Expert Guidance

No matter how many inquiries you have, our team is always ready and available to assist you in the best way possible.

-

Transparent Pricing

Not all surprises are fun! We make sure that you know exactly what you’re paying for.

-

Solution Focused

We prioritise your needs, providing exclusively tailored solutions for you.

Get Accounting Off Your Plate

Outsource your accounting to experienced professionals. Ensure accuracy and compliance with ease

Testimonial

Hear from our satisfied clients who have experienced the benefits of our corporate services. Our tailored corporate solutions have helped businesses overcome challenges and achieve their goals, proving the effectiveness of our expertise.

Our accounting associate at Grof is extremely diligent in following up with us on all of our paperwork needs, is able to advise us on tax matters and does her work well enough so that we can focus on doing what we love doing best.

Grof is also proactive in coming up with creative solutions (like their new app) to help make the bookkeeping process easier, and we appreciate that greatly.

Wei Choon and Ruiming

Co-founders of The Woke Salaryman

Superb service! Decided to go ahead with Grof instead of other competitors because of their product offering and they did not disappoint. The service was prompt, good and we got our company incorporated within the same day.

Jeff Lim

Co-Founder of Buildas Pte Ltd

It has been a pleasure working with Liyana Azman and team at Grof. They are responsive and know their stuff. We’re well guided throughout the process till the final registration of the company.

Hock Lye Khaleel CHAN

Founder of YouM Pte Ltd

Very attentive, quick to react and action decisions through their streamlined way of operation. You can expect great service from them.

Shai Parientte

CIO of BSW TECHNOLOGIES SG PTE. LTD.

Grof had really understand my case. Very helpful and responsive!

Hideaki Onishi

Founder of Hideaki Onishi Music

We moved so quickly as a new startup. We received venture funding offers before we even incorporated or had a bank account. But Grof kept up with our pace. They're fast, friendly, and professional. We can't recommend them enough!

Aaron Yip

CEO at Issa Compass

Frequently Asked Question

Our FAQ section provides detailed information about our solutions, ensuring you have all the knowledge you need to make informed decisions.

How can I work with Grof’s accountant?

Our accountants are just a click, call, or message away, always ready to chat and sort out your numbers. And guess what? You get a whole squad of book-balancing heroes, not just one!

All your accounting related questions

What are the accounting records I should keep in order to pass them to Grof?

Do keep your bank statements, customer invoices, bills, payroll, and other accounting records in the year. It'll be great if they are in digital format so our team can access them readily.

I have not set up a corporate bank account for my company yet, but I have already incurred certain business-related expenses, such as the cost of incorporating the company. How should I record this in the bookkeeping?

You can record this as the amount due to you. It is quite common for startups to cover expenses personally in their initial stages. Once the company's business account is set up, you can seek reimbursement for the expenses you paid earlier.

Do my financial statements need to be audited?

Since 1st July 2015, companies can be exempted from auditing their financial statements if they qualify as a small company.

There are 2 conditions for a company to qualify as a small one. Firstly, a company has to be private in the financial year in questions. Next, a company has to meet at least two of the following three criteria for the immediate past two consecutive financial years:

- Total annual revenue is not more than $10 million.

- Total assets are not more than $10 million.

- The number of employees is not more than 50.

All Your Tax-related Questions

What is Singapore’s tax rate?

The tax rate stands at 17% in Singapore. Businesses can benefit from generous tax exemptions provided they align with the Inland Revenue Authority of Singapore (IRAS) stipulations.

Is my accounting profit the same as taxable income?

Not exactly. Your accounting profit, which follows Generally Accepted Accounting Principles (GAAP), might differ from your taxable income, which plays by the Income Tax Act's rules. Here's the lowdown on the differences:

- Some gains in your books won't be taxed.

- Tax rules don't always recognise depreciation like accounting does.

- Certain expenses you might write off, like some car costs and penalties, aren't tax-deductible.

What about this ECI thing, and when's the deadline?

ECI, or Estimated Chargeable Income, is due to IRAS 3 months post your company's Financial Year End. Say your year wraps up on December 31st; you'll need to submit ECI by March 31st the following year. ECI's your best guess at your company's taxable profits after accounting for tax-allowed expenses.

If my ECI's looking like zero or negative, do I still file?

If your ECI is nil/ negative, and your revenue is less than $5M, you do not need to file ECI. You are still required to submit the Form C/ C-S by 30 November every year.

All Your GST-related Questions

What is Singapore's current GST rate?

As of 1 January 2024, the GST rate in Singapore is set at 9%.

Am I eligible to claim GST?

If your company is GST-registered, you can claim GST provided: The goods and services are imported or bought by your company. They are intended for business use. They aren't excluded by GST (General) Regulations 26 and 27.

When should I register for GST?

Register for GST when your annual turnover hits or is expected to hit $1M within the next 12 months.

Can Grof assist with GST account management?

Absolutely! Grof has a proven track record of assisting hundreds of clients with their GST reporting on time and within regulations.

All Your Shareholder-related Questions

How should I record the funds I deposit or withdraw as a shareholder?

Deposits are typically recorded as shareholders' capital, and withdrawals are treated as loans to shareholders, both reflected in the company's bookkeeping.

Is it possible to pay shareholders a monthly or yearly salary?

Certainly, shareholders may receive salaries if employed by the company, ensuring all social contributions are settled. For detailed assistance, our payroll service team is at your service.

Latest Blogs

Featured articles you might be interested in!

-

How Outsourcing Accounting Services Benefits You

Find out how outsourcing accounting services will benefit your company!

Read More -

The Importance Of Accounting And Bookkeeping Services For Businesses

A closer look into how accounting and bookkeeping benefits your services.

Read More -

Accounting Checklist For FYE In Singapore

The ultimate guide for you to prepare accounting statements for FYE in Singapore.

Read More